1. Introduction

During the last decade, an increasing trend to establish new alternative crops has appeared in Greece. These crops are promising alternatives to “traditional”, low-production cultivations. It is widely acknowledged that the diversification into higher-value crops could be a promising option for a large number of small and average-sized farms, particularly during the current economic crisis, advancing the climate-smart agricultural approach [

1].

Many of the suggested alternatives have remarkable advantages, such as the ability to grow in poor farmlands, utilizing sodic soil and poor quality irrigated water. This poor farmland is a common situation in several areas in Greece, such as the Aegean islands. Indeed, the economic utilization of sodic lands is a challenging task [

2]. In sodic soils, plant growth suffers due to various constraints, which negatively affect the plant productivity and growth [

3,

4].

One of the most promising alternative crops that have been established rapidly and massively in Greece in the last few years is the organic

Aloe vera L. (

A. vera).

Aloe vera farming is gaining momentum in recent years because of its growing importance and increasing market demand [

5]. Aloe plantations were first established in Greece in the south area of Crete in the 1990s. During the past five years, the cultivation has expanded on several Aegean islands, in Peloponnesus, and the south part of the Greek mainland [

6].

Aloe vera is a perennial plant, native to the Mediterranean region, that can utilize sodic lands [

2,

7,

8,

9,

10,

11].

Aloe vera is the most popular among 400 aloe species due to its potent biological activity and its wide availability [

5]. Many biological activities have been attributed to this plant’s gel [

12,

13,

14,

15,

16,

17] whereas its usage in numerous medical and cosmetic applications since ancient times is well-known [

18,

19]. Moreover, there is a remarkable recently developed on-going literature regarding the effect of on-farm practices on the quantity and quality of the

Aloe vera gel [

5,

20,

21,

22,

23].

In this study, we explore the economic sustainability of organic Aloe vera crops, using data from 33 organic aloe producers. To incorporate the embedded risk and uncertainty, stemming from the achieved yields and the market structure, into the analysis, we apply stochastic budget modelling. Moreover, the effect of the market failure to fully absorb yields and the effect of the change in the tax regime (institutional risk) are explored using sensitivity analysis. Finally, we estimate certainty equivalents (CE) to illustrate farmers’ willingness to establish an organic Aloe vera crop, relative to their risk aversion attitude.

The remainder of this paper is organized as follows. The next section describes the applied methodology and the data used in the study. The empirical application is then illustrated and discussed. This paper ends with a brief summary of the main findings and certain concluding remarks.

2. Materials and Methods

The economic sustainability of organic Aloe vera farming is approached through two main economic indicators: net profit (NP) and family farm income (FFI). Although the first is the most commonly used indicator for the evaluation of various economic activities, FFI has distinct importance in agriculture and is closely related to the notion of economic sustainability. FFI indicates the reward of the production factors that belong to the family; thus, it is a measure of its wealth.

Using FFI as the appropriate indicator for economic sustainability has also been applied by van Calker

et al. [

24,

25], whereas numerous articles focus on this index to evaluate the economic performance in agricultural enterprises (e.g., [

26,

27,

28,

29]). In Greece, the agricultural households usually own the farmland and the capital. Therefore, the family farm income is calculated as the sum of the net profit, the implicit rent of the farmland, the implicit cost of family labor, and the opportunity cost of family-owned capital (interests).

Conversely, NP is a more proper indicator of economic sustainability for a more “business” type of farming, where the agricultural enterprise is closer to a typical economic activity rather than to a family farming activity. Therefore, in this study, we consider FFI as the proper indicator when considering the wealth and the economic sustainability of a family farm, and NP as the proper economic indicator for a more entrepreneurial agricultural enterprise.

To incorporate risk and uncertainty in the estimation of NP and FFI, we implement the stochastic budget simulation modelling. In this model, the variables that incorporate risk and uncertainty are introduced in the budget analysis not in a deterministic but in a stochastic manner. More specifically, the stochastic variables take their values randomly from a pre-specified distribution.

Organic aloe farmers encounter two outstanding sources of risk. First, they encounter yield risk because the Aloe vera crop is exposed both to weather conditions and to pests and diseases. This risk becomes more important, considering that aloe crops are not yet insured by the national agricultural insurance agency; in addition, there is a lack of historical data on yields.

The second source of risk stems from the market and relies on producers’ prices and quantities that are distributed through each available market channel. Since the market channels for organic Aloe vera leaves are not yet well established in Greece, there is a high vulnerability of price levels and an intense uncertainty on the total volumes that these markets can distribute. Three main marketing channels are identified in Greece. The first refers to the existing processing units located in Greece, which has a (yet small) demand for organic Aloe vera leaves. The second refers to special retail markets (such as pharmacies, organic groceries, and delicatessen supermarkets) where fewer quantities are released, but at much higher producer prices. Finally, a few direct sales to sophisticated consumers at higher prices have also been reported.

Due to the establishment of an organic

Aloe vera farm being a risky economic activity, its adoption relies on the risk attitude of the potential aloe bio-farmers. Individuals with high risk aversion levels may prefer a more “traditional” crop, with less risky prospects. To quantify the risk attitude of the potential aloe bio-farmers and to assess their willingness to establish an organic aloe crop, we apply the stochastic efficiency with respect to a function (SERF) analysis, which was first introduced by Hardaker

et al. [

30]. SERF analysis allows the comparison of risky alternatives and provides a graphical representation of the results with different risk preferences in a transparent manner. Moreover, SERF computes the certainty equivalent (CE) over a range of relative risk aversion coefficients. The CE is equal to the amount of payoff a farmer would require to be indifferent between that payoff and the risky activity [

30,

31]. The CEs are readily interpreted because, in contrast to utility values, they are expressed in monetary terms.

For a risk-averse decision maker, the estimated CE is typically less than the expected money value. The difference between the expected money value and the CE is the risk premium [

30,

32], which reflects the minimum amount that would need to be paid to a decision maker to justify his involvement in organic aloe farming. Intuitively, a positive certainty equivalent reveals that the potential farmer is willing to be involved in this activity; conversely, if the certainty equivalent is negative, the farmer will reject that economic prospect [

30].

2.1. Model Specification

The stochastic budget simulation model for NP is as follows:

where:

: Stochastic yield of the organic aloe crop (tons of harvested leaves)

: Stochastic absorption (%) of the yield from the market channel i ()

: Stochastic price of the organic aloe leaves in market channel i

: Stochastic variable cost of organic aloe farming. The stochasticity of this factor emerges from the stochastic cost of harvesting and shipping of organic Aloe vera leaves, which in turn depends on the (stochastic) yield of the Aloe vera crop.

: Capital cost of organic aloe farming

Furthermore, the simulation model for the FFI is as follows:

where:

Land: implicit cost (rent) of the family-owned farmland

: The implicit cost of family labor. This variable has a stochastic component due to the family labor demand for harvesting, which, in turn, depends on stochastic yields.

: The opportunity cost of family-owned capital.

Each stochastic model estimates the probability of each level of the independent variable (NP and FFI) to occur, providing a range, with minimum, maximum and mode values. Moreover, the model provides the probability of a negative value and, therefore, the probability of losses. The distributions of NP and FFI were developed in the Simetar 2011

© environment. Simetar 2011

© simulates a probability distribution based on the stochastic variables defined. A Latin Hypercube simulation was used instead of the most popular, but less efficient, Monte Carlo simulation [

30,

31,

33].

2.2. Data Description

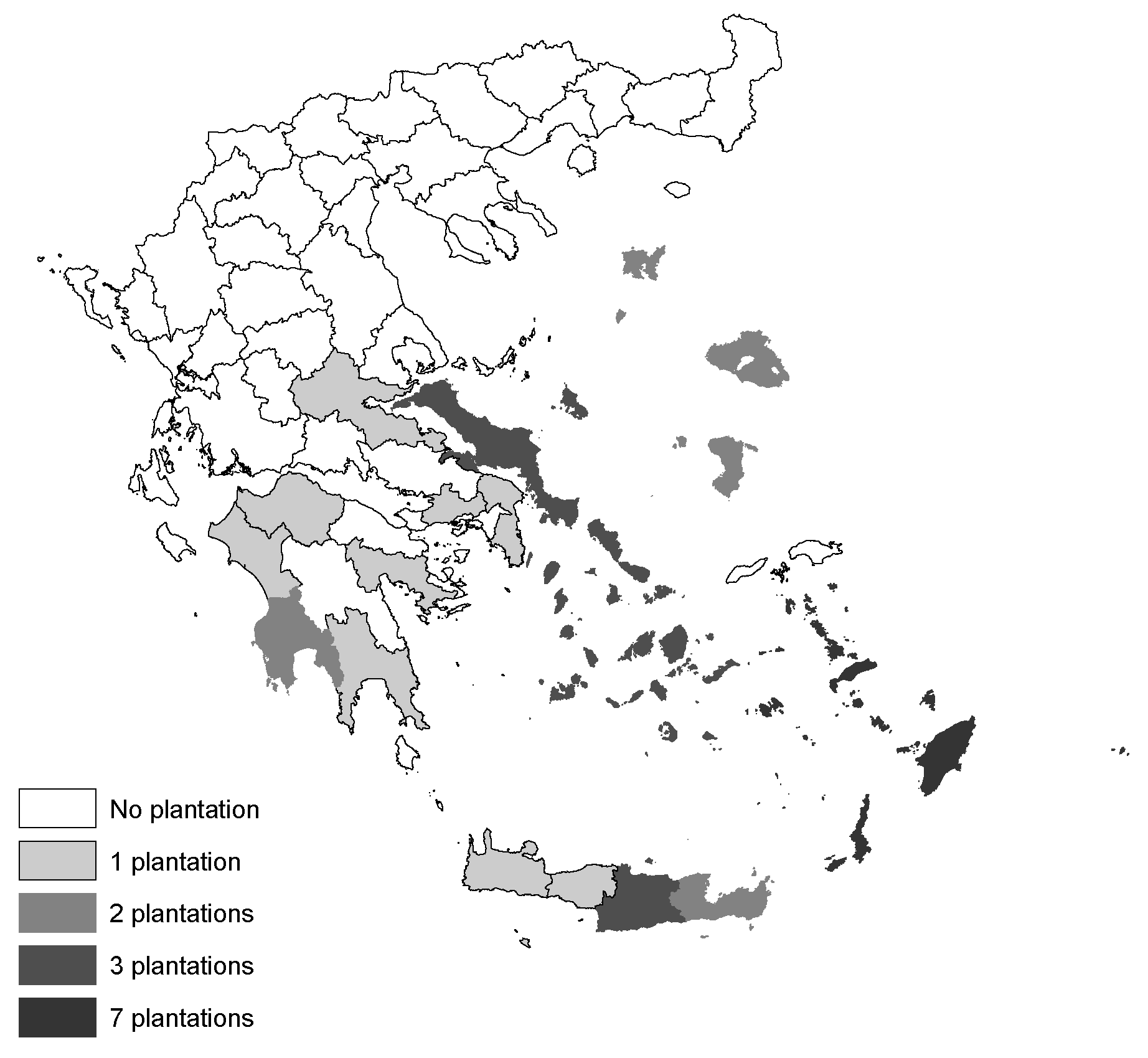

Data used in this analysis were obtained by personal interviews with 33

Aloe vera producers in several areas in Greece, particularly in the Aegean islands, Peloponnesus, and Crete (

Figure 1), using a detailed socioeconomic questionnaire. Organic

Aloe vera farmers provide detailed historical data on the establishment cost of an

Aloe vera crop as well as the annual costs of the crop. However, in the revenues part, because the vast majority of the farmers have distributed very minimal quantities in the markets, many of them, only report their expectations.

It must be noted that the average farm size of the sample is very low (less than 0.2 ha), whereas only one farm has a size larger than one hectare. Therefore, aloe farms are not scale efficient and they cannot take advantage of economies of scale to lower their annual costs.

2.2.1. Revenues

The estimation of the revenues is based on the sum of the right side of Equation (1):

. Utilizing the data collected as well as experts’ advice, the stochastic yield (

) is approached by a GRKS distribution with modified tails. This distribution is, in fact, a modified triangular distribution and called GRKS distribution after for its developers, Gray, Richardson, Klose, and Schuman [

34]. The GRKS distribution is useful when minimal information is available about the distribution, requiring only minimum, mid-point, and maximum values as the bounds for the distribution [

34]. The GRKS distribution assumes that 50% of the observations are greater than the mode value. Additionally, the distribution draws 2.28% of the values from above the maximum and 2.28% from below the minimum. However, in this study, the tails of the GRKS distribution were altered in such a way that the maximum and minimum probabilities of occurrence are 10%, each. The min, the mid, and the max value of this distribution are presented in

Table 1.

The price data are the most intriguing part of this study because the markets are not yet well established. Using the most relevant information from the markets, as well as the expectations of the producers, we construct six stochastic variables based on different triangular distributions. The first three variables (

) regard the prices that farmers encounter in the three corresponding market channels (processing units, retail markets, and direct sales). The next three variables regard the percentage of the production that each market channel distributes (

) (see

Table 1).

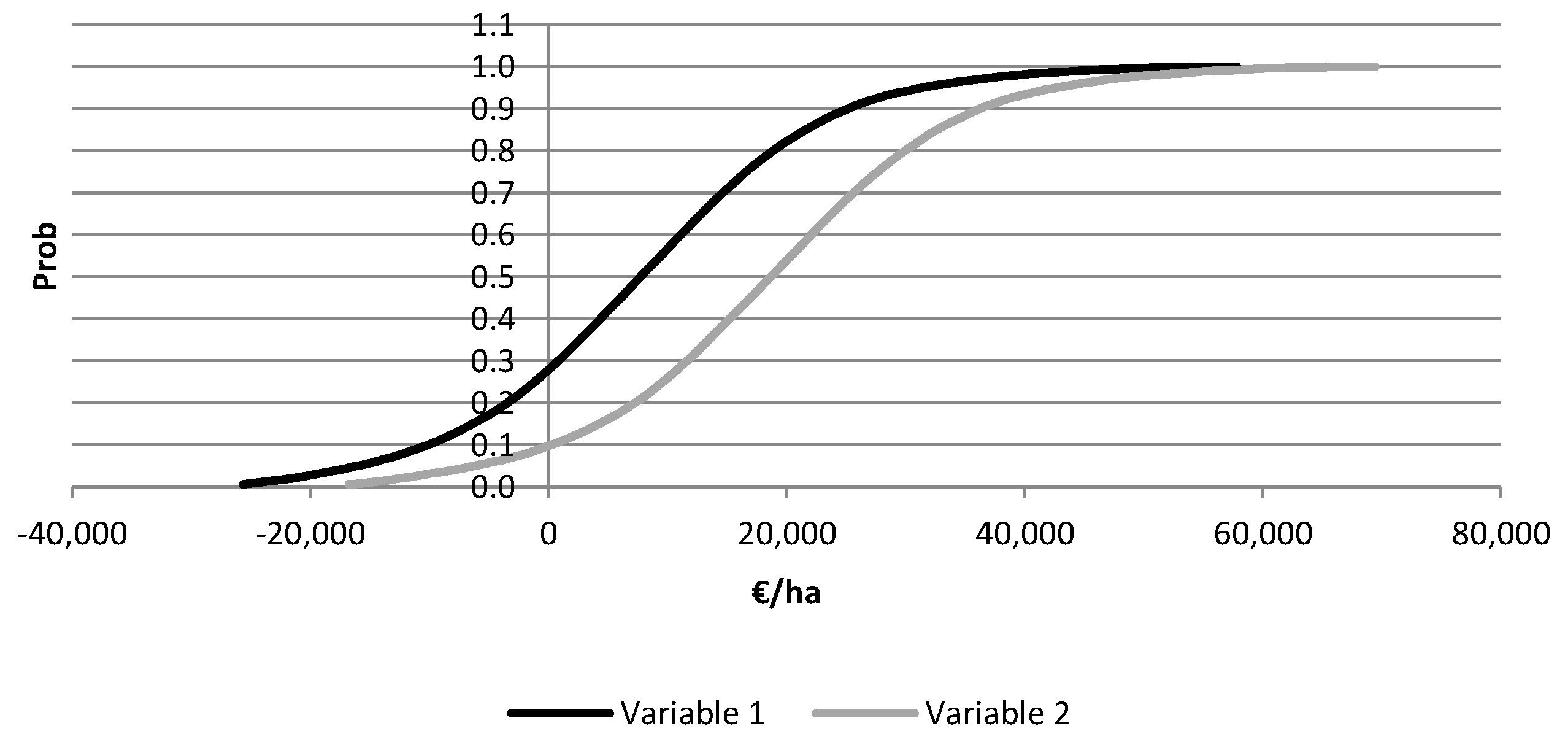

Given the above stochastic variables, revenues per ha are estimated stochastically and are illustrated in

Figure 2, while

Table 2 presents their expected values. According to

Figure 2, in 95% of cases, revenues fluctuate from 8,000 €/ha to 80,000 €/ha, whereas the mode value is approximately 50,000 €/ha.

2.2.2. Cost of Production

Table 3 presents the expected annual production costs. The most important element of the production cost is the annual cost of capital, which contributes to 42% of total expenses. This finding is primarily the outcome of the extremely high shoots’ price to establish the crop. However, this finding is also encouraged by the small size of the farms, which does not utilize economies of scale.

Labor cost and variable costs are very similar (approximately 26% of total cost), whereas the cost of farmland (rent) constitutes 6% of the total costs. The family labor contributes to approximately 80% of the labor cost, which indicates that the farmers utilize family labor and hire labor only occasionally (at peak seasons, such as harvesting). Regarding the variable costs, it is important to mention the shipping costs as an important cost element. Considering that this factor varies greatly on the accessibility of the farm to the processing unit, it can vitally affect the geography of the cultivation, particularly if revenues are not much higher than production costs.

3. Results and Discussion

3.1. Stochastic Budget Modelling

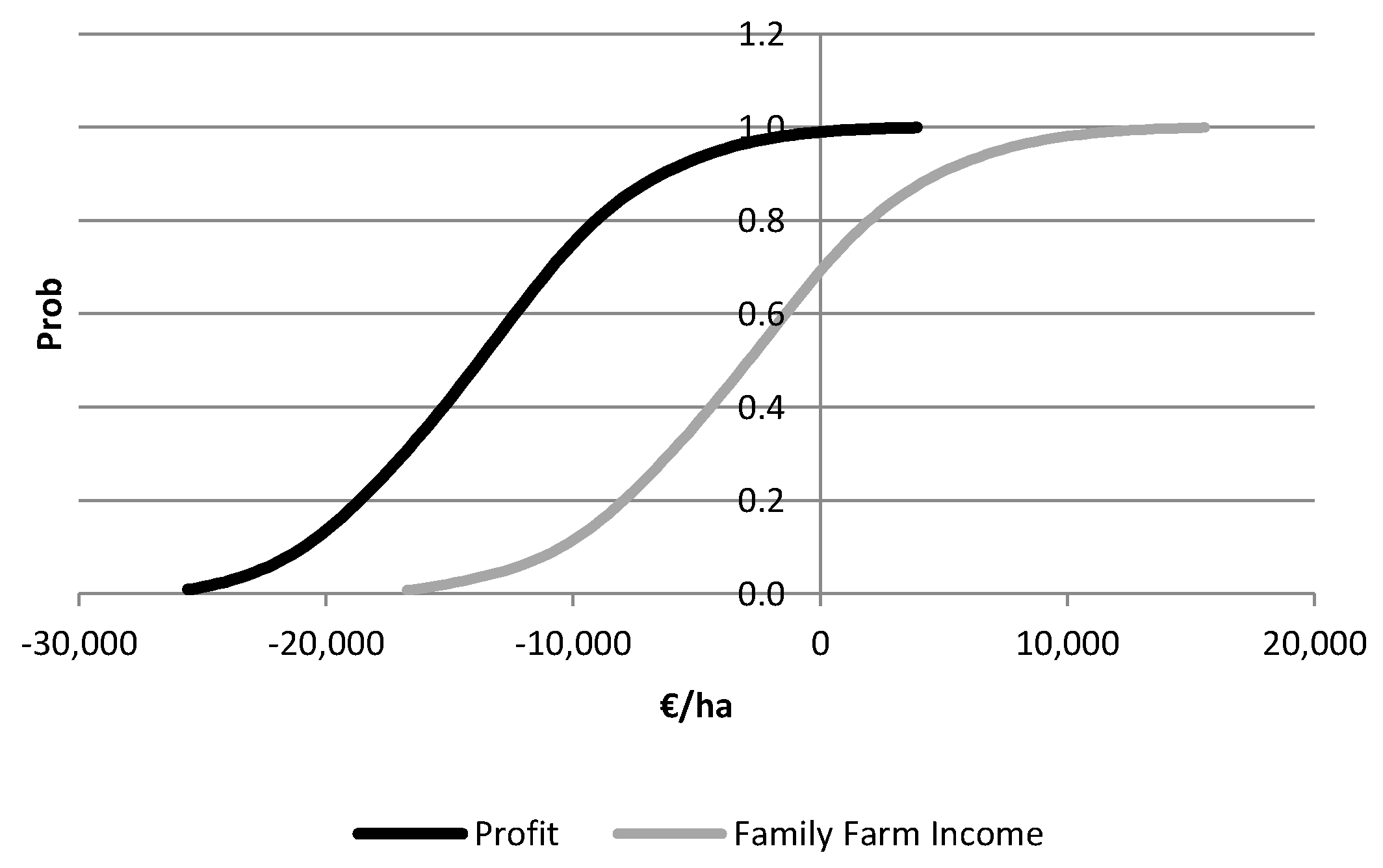

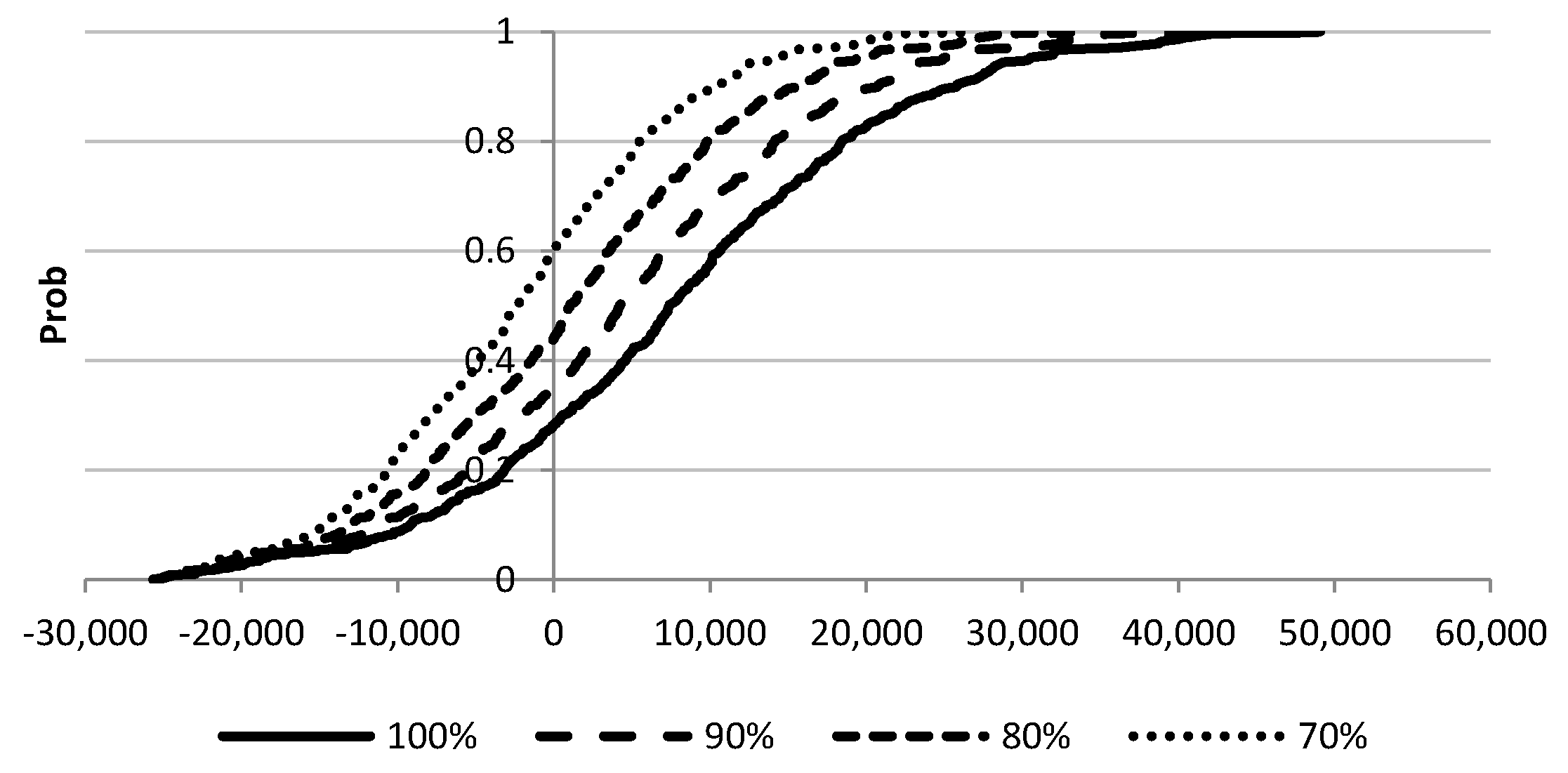

The estimations of models (1) and (2) provide the stochastic NP and FFI from the organic

Aloe vera activity (

, respectively). The descriptive statistics of each indicator are provided in

Table 4. Moreover, the cumulative distribution functions (CDFs) of these indicators are constructed to demonstrate that the probability of each indicator (on the Y-axis) is less than a particular level (on the X-axis) (

Figure 3).

The break-even analysis indicates that the expected break-even yield is equal to 35 tons per ha, which corresponds to approximately seven aloe leaves per plant of approximately 500 g each. Additionally, the expected break-even price (covering direct costs) is equal to 0.25 €/kg. Therefore, a farmer who distributes organic Aloe vera leaves only to processing units may not cover the direct costs, considering that the minimum producer price in this market channel is equal to 0.2.

Figure 3 and

Table 4 reveal that, on average, an organic

Aloe vera plantation produces positive NP and FFI. However, there is an important variability in the results that reflects the riskiness of this activity. In addition, there is a high probability for negative NP (27%) but not for negative FFI (<9%). Considering that, according to 2011 EU-SILC survey, a relative poverty threshold for Greece at €13,842 for a four-member household with two adults and two children [

35], on average, the size of the crop should be at least 0.75 ha to cover the living cost of four-member household in Greece.

A closer examination of the formation of the stochastic revenues (see

Table 2) indicates that while the vast majority of the production is distributed to the processing units’ market channel, the main part of the revenues stems from the other two market channels, which provide higher producer prices for the organic

Aloe vera leaves. Indeed, although 87% of the production is distributed to processing units, the corresponding revenues are 40% of total (17,333 €/ha of 43,289 €/ha). Conversely, the other two marketing channels distribute 13% of the production; however, they contribute 60% of total revenues.

Therefore, the lower levels of revenue are achieved when the quantities absorbed by the processing unit are high and/or the producer price at this market channel is low. To visualize the importance of these two factors, we alter the stochastic budget model; first, by turning into a deterministic variable with value equal to the minimum of the GRKS distribution of price (0.2), and second by turning into a deterministic variable with the maximum value (100%) of the corresponding GRKS distribution.

The results are presented in

Figure 4 and

Figure 5, respectively. In both cases (and particularly in the former), there are severe consequences to both economic sustainability indicators. This result emphasizes the fact that the processing units should provide a fair producer price level to ensure the sustainability of the organic aloe farms. Additionally, organic aloe producers cannot solely rely on the processing units for the distribution of their yields. The producers also have to utilize the other two, more efficient market channels.

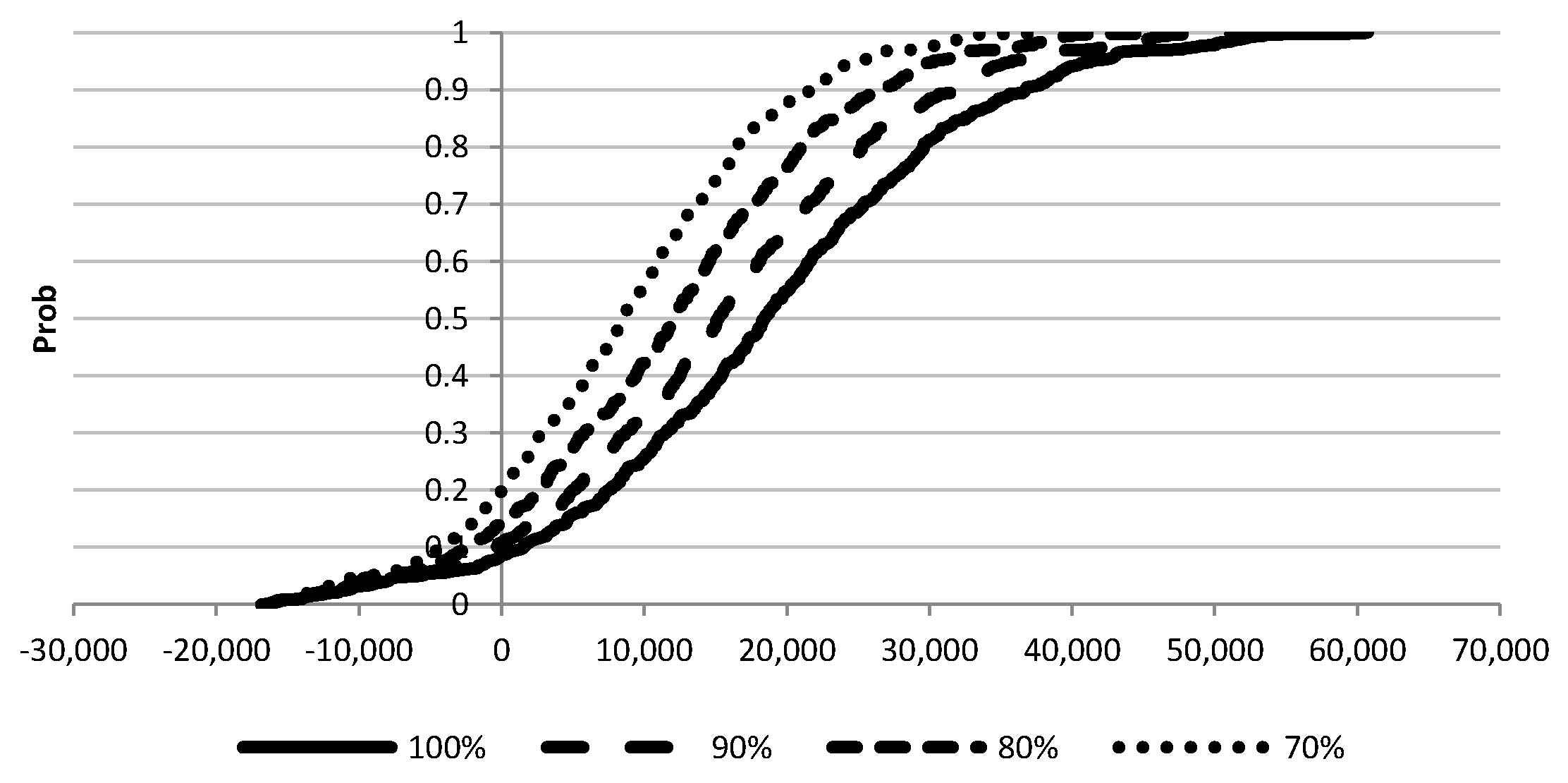

3.2. Sensitivity Analysis

In the stochastic models (1) and (2), we incorporate the risk and uncertainty associated with several factors that affect NP and FFI. However, there are also certain other critical factors of high importance that can greatly affect the level of these economic indicators. The effect of these factors is examined using the sensitivity analysis.

The first critical factor is related to the market absorption of the yields. In models (1) and (2), we assume that

, (

i.e., total market absorption of the yields). However, the absence of a well-established market channel as well as the economic crisis can create several distortions and cannot guarantee the full market absorption of the yields. Sensitivity analysis reveals how the levels of the economic indicators changed when the market absorption of the organic leaves is 90%, 80%, and 70% (

Table 5 and

Table 6,

Figure 6 and

Figure 7).

The results of the analysis indicate that the effects are more severe on the net profit of the farms. In the case of 70% market absorption, the average value is negative, whereas the possibilities for negative NP values increase to 44.18%, indicating a very risky economic activity. The effects on the FFI are less severe but also important. A 70% market absorption of the leaves affects, by more than 50%, the expected level of FFI, whereas the possibilities of a negative value increases to 20%.

The second critical factor regards the tax regime. Until recently, farmers enjoyed an attractive tax regime, which did not significantly affect their economic results. However, the recent reform of the tax regime includes a 13% tax on the profits of the farmers; this has already been incorporated into the analysis. Moreover, in the near future, the alignment of farmers’ tax regime to that of the enterprises in the other sectors of the economy, is expected to occur. Until year 2015, this level was equal to 26%.

To consider that risk, we conduct a sensitivity analysis on the effect of the tax rate to the indicators of economic sustainability. More specifically, we explore two scenarios: the first is the tax-free scenario; the second is the 26% tax scenario. The results of this analysis are presented in

Table 7 and

Table 8.

The results indicate that the expected values of the economic sustainability indicators are significantly affected by the tax regime. However, because the effect of taxes applies only to profitable farms, the probability of a value less than zero is the same in each scenario. These results highlight the role of the policy makers in the adoption and expansion of alternative crops in Greece and emphasize the negative economic effects that a policy regime can cause on agricultural enterprises.

3.3. Effect of Farmers’ Risk Attitude

In the previous analysis, we explore how the risk and uncertainty affect the economic sustainability of the organic aloe farms. In this section, we introduce the risk attitude of the farmer as a key indicator for the establishment of an organic

Aloe vera crop. The main idea is that, according to their level of risk aversion, a farmer is willing to adopt or to reject the prospect of the establishment of an organic

Aloe vera crop. The quantification of farmers’ willingness to establish an organic

Aloe vera crop is accomplished via the estimation of the certainty equivalents (CEs) at different levels of risk aversion, using the SERF analysis in Simetar (College Station, TX, USA) 2011

© [

30,

31].

The level of risk aversion is measured by the Absolute Risk Aversion Coefficients (ARAC). Generally, there are no specific ranges for ARACs. For example, according to Thomas [

36], that range should be from −0.0005 to +0.005. However, it appears more appropriate to normalize the range of ARAC against wealth. The relation between absolute and relative risk aversion is: r

a(w) = r

r(w)/w, where r

r(w) is the relative risk aversion coefficient with respect to wealth (w) [

30]. Anderson and Dillon [

37] proposed a general classification of degrees of risk aversion, based on r

r(w), in the range of 0.5 (hardly risk averse) to approximately 4 (extremely risk averse).

In accordance with Fathelrahman

et al. [

38], the average wealth is approached by the expected farm family income, which is estimated to 18,631 €. Assuming a 10% return (R) on the value of the assets with a normal debt to asset (DA) ratio of 20%, the ARAC at the extremely risk averse level (4) can be calculated as: 4 / [(1−DA) × (w/R)]. Therefore, the upper limit of ARACs is equal to 0.00024.

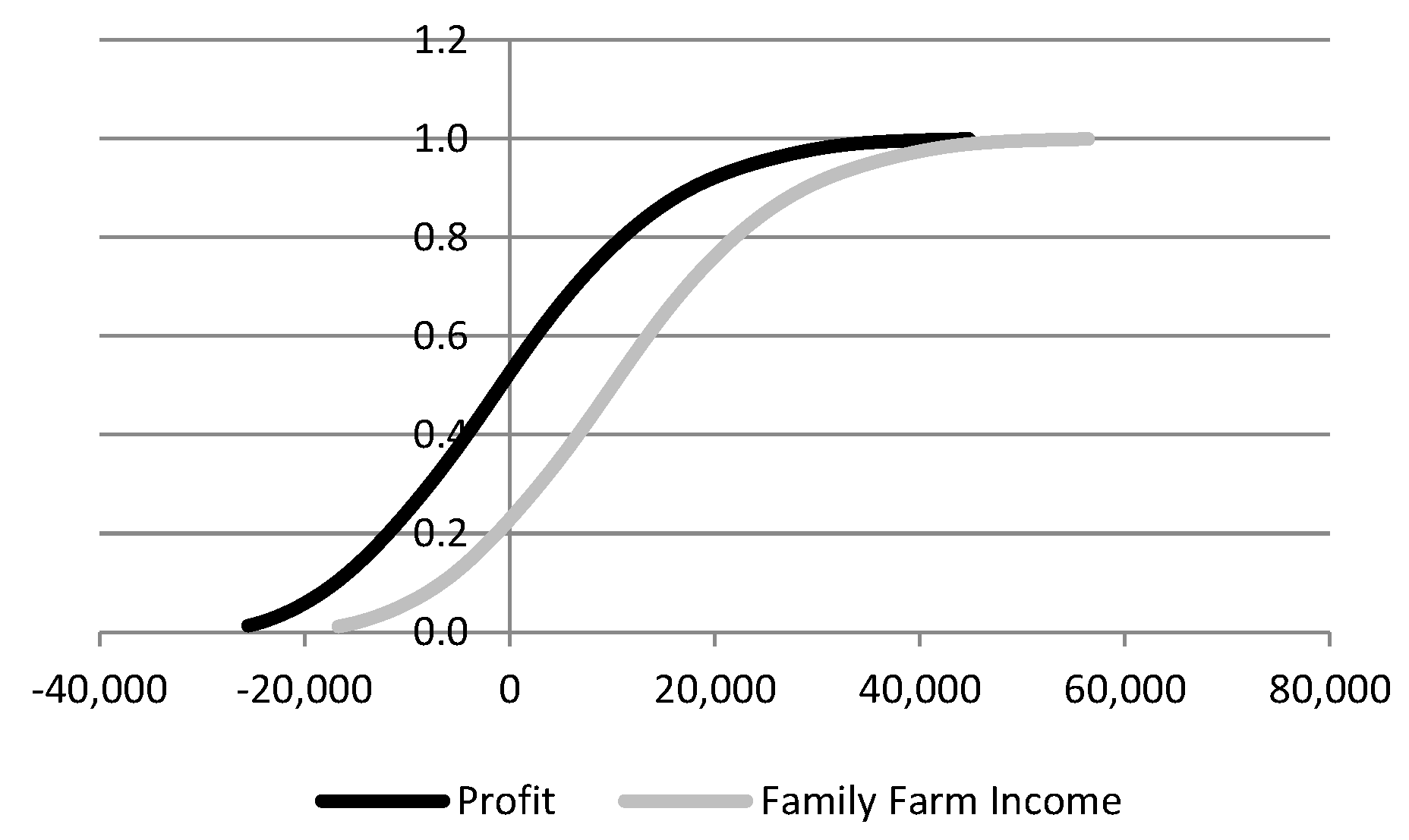

Additionally, we estimate CEs using both NP and FFI, remembering the discussion on the economic sustainability indicators. Indeed, these two economic indicators fit to different patterns of economic agents. The CEs relative to the farmer’s risk aversion are presented in

Figure 8. The CEs are (as expected) greater for the FFI, indicating that given the facts of this crop, it appears more suitable for a more traditional type of farming activity. Moreover, this cultivation is not suitable for farmers with high risk aversion.

4. Conclusions

This study explores the economic sustainability of organic Aloe vera farming, considering the risk and uncertainty embedded in it. Aloe vera farming is a very promising activity and is gaining momentum globally because of its increasing market demand. In Greece, the commercial cultivation of Aloe vera has been growing rapidly; however, there are, as yet, no direct market chains with the pharmaceutical and cosmetic industries that need Aloe vera gel for their production lines. Therefore, a main source of risk stems from the existing inconsistencies throughout the marketing chain that fail to create the supply to meet the demand for aloe leaves by the industries. The second important source of risk stems from the achievement level of yields because the extreme weather conditions and insufficient pests and disease control can greatly affect production. Finally, the volatile farmers’ tax regime adds one more source of risk to the activity.

The analysis reveals that organic aloe farming is a promising alternative to “traditional” crops in Greece, particularly for family farms in rural areas, who have risk-neutral attitudes and who manage marginal farmlands with poor quality irrigated water. In contrast, the more entrepreneurial type of farmer is less willing to establish an organic Aloe vera crop unless the size of his crop allows economies of scale.

To conclude,

Aloe vera crops can assist to the reorganization and modernization of the agricultural sector in Greece and can create new economic opportunities for development within rural areas. As a prerequisite, a well-established marketing channel for the distribution of leaves to processing units at a fair producer price must be formed. There are encouraging signs from the market, as the global market of

Aloe vera extracts is expected to witness robust growth during the next decade. This is the outcome of the rising number of health-conscious consumers coupled with increasing consumer awareness regarding the benefits of

Aloe vera extracts [

39].

In addition, farmers must exploit more efficient marketing channels—either in Greece or abroad—and not solely rely on the distribution of their yield to the processing industry. In this respect, the further expansion of the organic Aloe vera farms can contribute to the economic and environmental sustainability in rural areas and encourage rural development.